Life Insurance

Most of us are very careful when insuring homes, cars, furniture, and other possessions. However, we sometimes forget to insure ourselves.

Life Insurance

We often forget that it is us, as individuals, who are responsible for the conditions we live in. Life can suddenly take an unexpected turn — and if you pass away, it can become a significant financial burden for your family.

A life insurance policy ensures that your loved ones are financially protected should the unthinkable happen.

A life Insurance is therefore intended to help your closest family members get financially back on their feet should you pass away before reaching the age of 67.

The payout will be made to the next of kin unless another written agreement has been made with LÍV.

The payout is tax-free.

Beneficiary Designation

The beneficiary designation determines who has the right to the payout in the event of death.

In most insurance agreements, it is specified that the insurance amount related to death will be paid out to the next of kin, unless another written agreement has been made with LÍV.

Creditor Protection

Creditor Protection: The payout will be made according to the beneficiary designation, and the payout is creditor-protected. This means the amount will be paid to the named recipient, and creditors cannot make claims against the payout from LÍV.

An exception applies if you have designated the estate as the beneficiary. If the payout goes to the estate, the money is not creditor-protected.

Debt Insurance: In this case, there is no creditor protection. The payout will go towards the loan with the financial institution, and the value of the property will increase accordingly. Creditors can make claims against the estate before it is divided among the heirs.

The increased value of the property also affects the inheritance share that the surviving spouse must divide with the children, unless this is limited by a will or there is an option to retain the estate intact (without division).

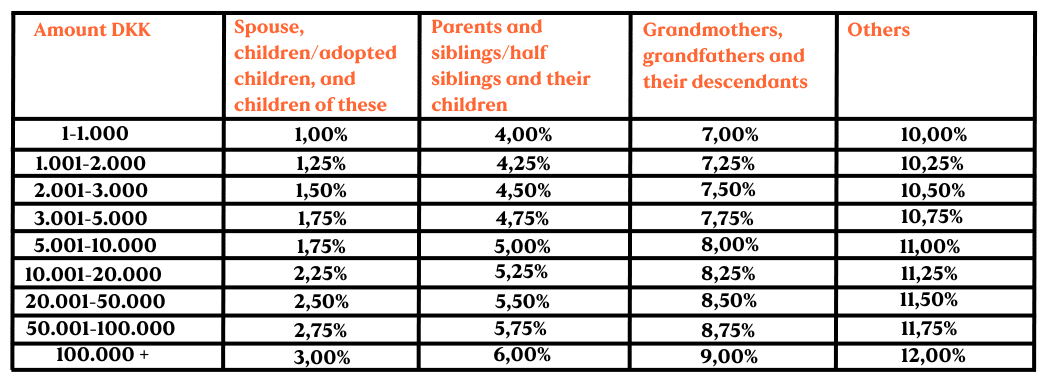

Inheritance Tax

When heirs receive an inheritance, an inheritance tax is levied on the amount distributed. The tax is set based on how closely related the heir is to the deceased. The inheritance tax system is composed of four groups.

EXAMPLE: An inheritance of DKK 40,000, which is distributed to a cohabitant, is subject to an 11.5% tax. An inheritance distributed to companies, etc., is subject to a flat 10% inheritance tax. The above information is provided as guidance from the Inheritance Tax Act (Lov om arveafgift), which applies in the Faroe Islands.

More detailed regulations can be obtained by contacting the Probate Court, which manages inheritance taxes.

Most life insurance policies today are taken out as group insurance

With a group insurance policy, you have the opportunity to include:

Life insurance, critical illness coverage, and disability insurance in one combined package.

Are your insurances properly tailored?

When changes occur in your life, you should check whether your insurance policies still meet your current needs.

Which Insurance Is Right for You?

Everyone’s needs are different, and they can change multiple times throughout life.

Get an obligation-free conversation with us about your specific needs.

EXAMPLE 1

Monthly payment DKK 162,50

Insurance until age of 67 1/2

Payout in case of death

15-49 yrs

Dkk 500.000

50-54 yrs

Dkk 400.000

55-67 1/2 yrs

Dkk 300.000

Certain Critical Illnesses

Pay out in one Lump-Sum

DKK 125.000

EXAMPLE 2

Monthly payment DKK 262,50

Insurance until age of 67 1/2

Payout in case of death

15-49 yrs

Dkk 1.000.000

50-54 yrs

Dkk 800.000

55-67 1/2 yrs

Dkk 600.000

Certain Critical Illnesses

Pay out in one Lump-Sum

DKK 125.000

EXAMPLE 3

Monthly payment DKK 548,50

Insurance until age of 67 1/2

Payout in case of death

15-49 yrs

Dkk 750.000

50-54 yrs

Dkk 600.000

55-67 1/2yrs

Dkk 450.000

Certain Critical Illnesses

Pay out in one Lump-Sum

DKK125.000

Inability to work insurance

Annua Benefit

DKK 80.000

We are ready to help you

If you have questions or would like advice, you are welcome to contact us.

Send us an email on liv@liv.fo, call us at +298 31 11 11, or log in to the customer portal

Mítt LÍV and send us a message