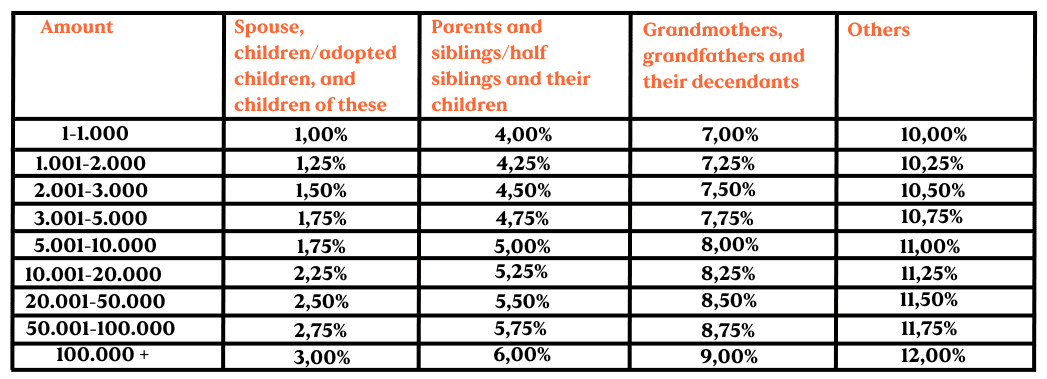

When heirs receive an inheritance, an inheritance tax is levied on the amount distributed. The tax is set based on how closely related the heir is to the deceased. The inheritance tax system is composed of four groups.

Example: An inheritance of DKK 40,000, which is distributed to a cohabitant, is subject to an 11.5% tax. An inheritance distributed to companies, etc., is subject to a flat 10% inheritance tax. The above information is provided as guidance from the Inheritance Tax Act (Lov om arveafgift), which applies in the Faroe Islands. More detailed regulations can be obtained by contacting the Probate Court, which manages inheritance taxes.