Pension law

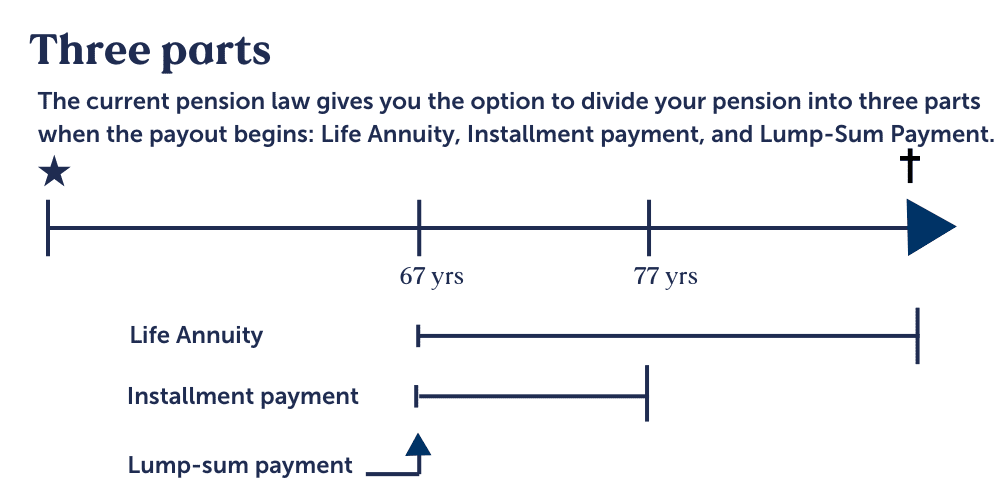

The applicable Pension Law, effective from January 1, 2014, provides you the option to divide your pension into three parts when payments begin.

The pension contribution will be taxed at the time of contribution, meaning that the pension payout will be tax-free.

- At least 45% must be paid out as a lifelong benefit (pension annuity), which according to the law is a pension plan that is paid out continuously as long as the policyholder (the person who owns and established the insurance) is alive, but ceases upon their death.

- At most 55% can be paid out as a deferred pension, which according to the law is a pension plan paid out over an agreed period, but for at least 10 years.

- A maximum of 15% can be paid out as a lump sum, which according to the law is a one-time payout.

Note: If the total pension savings with all Faroese pension providers is less than DKK 400,000 at the pension age as per §9, paragraph 2, up to DKK 60,000 can be paid out as a lump sum, and the rest will be paid in installments of up to DKK 2,500 per month. These amounts will be adjusted annually according to the price index.

Pension payments can begin at the national pension age according to the Social Pension Act, but no later than the day you start receiving the national pension. The current national pension age is 67.5 years.

The value of the contributions made during the contribution period is assessed as a capital savings plan with inheritance rights, unless you have chosen to establish the savings as a pension annuity with the inclusion of a beneficiary.

In the event of death, the payout will be made to the “next of kin” unless another written agreement has been made with LÍV.

You can find the full Pension Law here.